CUBIS CORE SYSTEM

Policy Administration

Streamline policy management with ease and precision. From issuing to renewal, our solution simplifies every step, ensuring accuracy, efficiency, and a seamless experience for both insurers and policyholders.

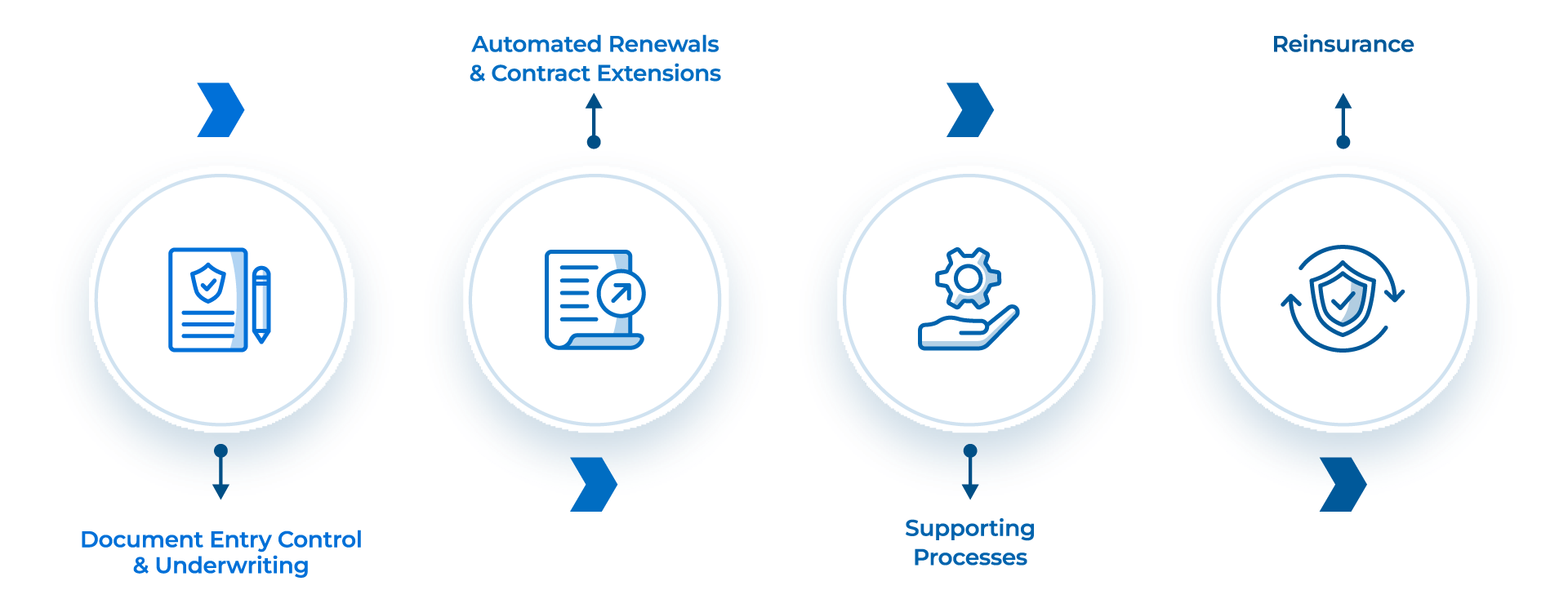

Document Entry Control & Underwriting

Smart Tools for Policy Validation

- Streamlined Verification Process

- Risk Assessment with Approval Workflow

- Integrated Document Management

Our system streamlines the verification process for insurance policies issued through the platform, ensuring that all required documentation and risk assessments are in place. The Document Entry Control and Underwriting module automatically checks submitted documents, mandatory or optional, and verifies pricing and coverage tariffs for most products.

For cases that exceed typical risk parameters, the system automatically generates an approval request directed to the back office, prompting manual review and intervention if needed. The integration of the Document Management System (DMS) is crucial, allowing insurers to organize and access all relevant documentation quickly. The system also supports PML (Probable Maximum Loss) assessments, helping insurers make informed risk decisions efficiently.

Automated Renewals & Contract Extensions

Policy Renewals for Long-Term Success

- Effortless Policy Renewals

- Minimized Lapse Risk

- Focus on Growth

The CUBIS system supports the automated renewal process for multi-year insurance contracts, ensuring a smooth and uninterrupted service for both insurers and clients. This automation simplifies policy renewals, reducing administrative workload and minimizing the risk of lapses.

Clients benefit from a seamless experience, with renewals processed efficiently and on schedule. This feature is particularly valuable for long-term contracts, allowing insurers to focus on portfolio growth and customer satisfaction without the added burden of manual renewal tracking.

Supporting Processes

Adapt and Communicate

- Mid-Term Adjustments Made Easy

- Client Engagement Tools

- Efficient Portfolio Management

CUBIS offers extensive support for mid-term changes throughout the insurance lifecycle. The platform manages contract amendments (endorsements) within the insurance year, allowing insurers to adapt coverage as client needs change.

Additionally, the system facilitates clear and organized communication with clients through automated notifications and correspondence, including the generation of Health Insurance cards when applicable. This ensures that clients stay informed and engaged, while insurers maintain high-quality portfolio management with minimal effort.

Reinsurance

Reinsure with Precision

- Comprehensive Agreement Tracking

- Optimized Risk Management

- Regulatory Compliance

Our system provides you with comprehensive reinsurance tracking and management, covering all reinsurance agreements at both the policy level and overall portfolio level. The platform supports various types of reinsurance arrangements, including facultative and obligatory reinsurance, helping insurers mitigate risk and enhance financial stability.

By maintaining a clear record of reinsurance contracts and details for each individual policy, CUBIS enables insurers to optimize their reinsurance strategies and maintain compliance with regulatory requirements. This module ensures that insurers can effectively manage reinsurance agreements with clarity and precision.

TESTIMONIALS

Trusted by Our Partners

Discover how our solutions empower businesses to excel. Hear directly from our long-standing partners about their experiences, successes, and the value we’ve brought to their operations.

Get in touch with us

Ready to transform your business operations? Contact us today or request a personalized demo for your company!

Efficiency, security, and innovation all in one platform – for you to accelerate, innovate, and grow your insurance business.